Microfluidic Soft Robotics in 2025: Transforming Precision Engineering and Automation. Explore the Breakthroughs, Market Growth, and Future Impact of Fluid-Driven Soft Machines.

- Executive Summary: Key Trends and Market Drivers

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Core Technologies: Microfluidics, Soft Actuators, and Material Innovations

- Leading Companies and Industry Initiatives (e.g., softroboticsinc.com, festo.com, ieee.org)

- Emerging Applications: Healthcare, Biomanufacturing, and Beyond

- Competitive Landscape and Strategic Partnerships

- Regulatory Environment and Industry Standards (e.g., asme.org, ieee.org)

- Challenges: Scalability, Integration, and Cost Barriers

- Investment, Funding, and M&A Activity

- Future Outlook: Disruptive Potential and Next-Generation Developments

- Sources & References

Executive Summary: Key Trends and Market Drivers

Microfluidic soft robotics is rapidly emerging as a transformative field at the intersection of soft materials science, microfluidics, and robotics. In 2025, the sector is characterized by accelerated innovation, driven by advances in materials engineering, miniaturization, and the integration of microfluidic control systems. These robots, constructed from compliant polymers and actuated by precisely controlled microfluidic channels, are enabling new applications in biomedical devices, minimally invasive surgery, and adaptive manufacturing.

Key trends shaping the market include the increasing adoption of soft robotic grippers and manipulators in the automation and healthcare sectors. Companies such as Soft Robotics Inc. are commercializing microfluidic-driven soft grippers for food handling and packaging, leveraging the technology’s gentle touch and adaptability. In parallel, Festo continues to develop bio-inspired soft robotic systems, including microfluidic actuators that mimic natural muscle movements, targeting both industrial automation and medical device markets.

The medical sector is a major driver, with microfluidic soft robots being integrated into next-generation surgical tools and diagnostic devices. For example, Boston Scientific is exploring soft robotic catheters and end-effectors for minimally invasive procedures, aiming to improve patient outcomes through enhanced dexterity and safety. The convergence of microfluidics and soft robotics is also enabling the development of wearable and implantable devices for drug delivery and physiological monitoring, with research collaborations between industry and academic institutions accelerating commercialization.

Material innovation remains a core enabler, with companies like Dow and DuPont supplying advanced elastomers and silicones tailored for microfluidic soft robotic components. These materials offer biocompatibility, durability, and precise actuation properties, supporting the deployment of soft robots in sensitive environments.

Looking ahead, the outlook for microfluidic soft robotics is robust. The next few years are expected to see increased investment in R&D, with a focus on scalable manufacturing techniques and the integration of artificial intelligence for autonomous operation. Regulatory pathways are also maturing, particularly for medical applications, which is anticipated to accelerate market entry. As the technology matures, microfluidic soft robotics is poised to become a foundational platform for innovation across healthcare, automation, and beyond.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The global market for microfluidic soft robotics is poised for significant expansion between 2025 and 2030, driven by rapid advancements in materials science, automation, and biomedical engineering. Microfluidic soft robotics—systems that integrate soft, flexible materials with microfluidic channels to enable precise, adaptive movement—are increasingly being adopted in sectors such as healthcare, wearable technology, and advanced manufacturing.

As of 2025, the market is characterized by a growing number of commercialized products and pilot deployments, particularly in minimally invasive surgical tools, drug delivery systems, and soft grippers for delicate manufacturing tasks. Leading industry players such as Parker Hannifin Corporation and Festo have expanded their portfolios to include microfluidic-driven soft actuators and robotic components, targeting both medical and industrial applications. Parker Hannifin Corporation is notable for its expertise in precision fluidics and soft actuator integration, while Festo has demonstrated advanced soft robotic grippers and automation solutions leveraging microfluidic control.

The compound annual growth rate (CAGR) for the microfluidic soft robotics market is projected to exceed 20% from 2025 to 2030, reflecting both increased R&D investment and the transition of prototypes to commercial-scale production. Revenue projections for 2025 estimate the global market size in the range of several hundred million USD, with expectations to surpass the USD 1 billion mark by 2030 as adoption accelerates in medical devices, laboratory automation, and precision agriculture.

Key growth drivers include the miniaturization of soft robotic systems, improved biocompatibility of materials, and the integration of microfluidics for enhanced dexterity and control. Companies such as DSM are contributing to the sector by developing advanced elastomers and biocompatible polymers tailored for soft robotic and microfluidic integration. Additionally, the emergence of startups and university spin-offs, often in collaboration with established players, is expected to further stimulate innovation and market penetration.

Looking ahead, the outlook for microfluidic soft robotics remains robust, with anticipated breakthroughs in autonomous medical devices, soft wearable exoskeletons, and adaptive manufacturing systems. Industry consortia and standardization efforts, led by organizations such as the IEEE, are likely to facilitate interoperability and accelerate commercialization. As the ecosystem matures, the market is set to experience sustained double-digit growth, underpinned by cross-sector demand and ongoing technological advancements.

Core Technologies: Microfluidics, Soft Actuators, and Material Innovations

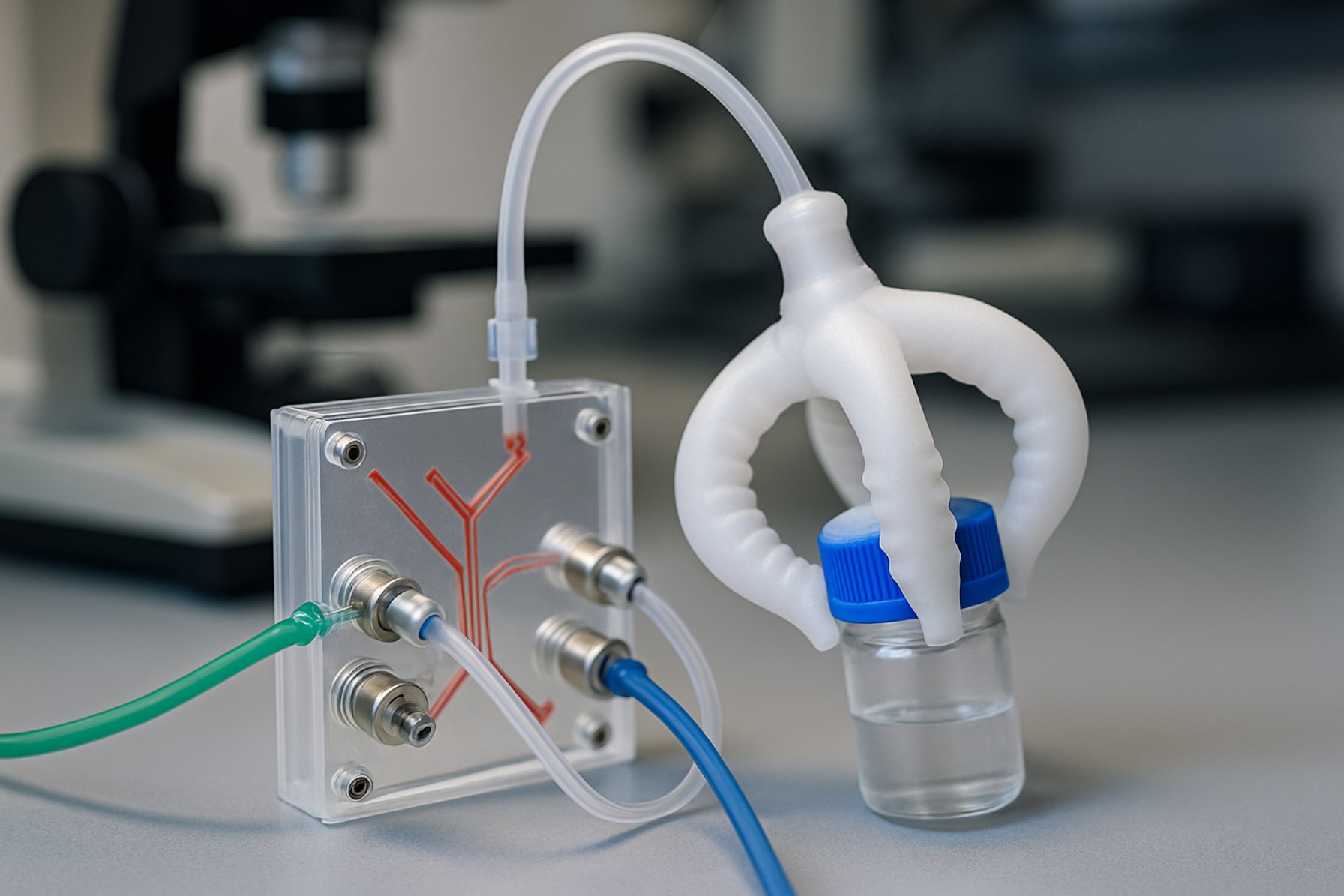

Microfluidic soft robotics is rapidly advancing as a convergence of microfluidics, soft materials, and robotics, enabling the creation of highly adaptable, biomimetic machines. In 2025, the field is characterized by the integration of microfluidic channels within elastomeric matrices, allowing for precise control of soft actuators through the manipulation of fluids at the microscale. This approach offers significant advantages in terms of flexibility, safety, and the ability to perform delicate tasks in constrained environments.

Key technological progress is being driven by the development of new elastomers and composite materials that enhance the durability and responsiveness of soft actuators. Companies such as Dow and DuPont are at the forefront, supplying advanced silicones and thermoplastic elastomers tailored for microfluidic device fabrication. These materials are engineered for biocompatibility, chemical resistance, and tunable mechanical properties, which are essential for both medical and industrial applications.

Microfluidic actuation systems are increasingly leveraging innovations in 3D printing and soft lithography, enabling the rapid prototyping of complex channel architectures. Stratasys and 3D Systems are notable for their additive manufacturing platforms, which support the fabrication of intricate microfluidic networks within soft robotic structures. This capability is accelerating the transition from laboratory prototypes to scalable, manufacturable products.

In 2025, the integration of microfluidic soft actuators is being explored in a range of sectors. In healthcare, companies like Medtronic are investigating soft robotic devices for minimally invasive surgery and targeted drug delivery, leveraging the gentle manipulation enabled by microfluidic actuation. In the field of industrial automation, Festo continues to develop soft grippers and adaptive end-effectors that utilize microfluidic channels for precise, damage-free handling of delicate objects.

Looking ahead, the next few years are expected to see further convergence of microfluidics with emerging material innovations, such as self-healing polymers and stimuli-responsive hydrogels. These advancements will likely expand the functional range of soft robots, enabling adaptive behaviors and enhanced resilience. The ongoing collaboration between material suppliers, device manufacturers, and end-users is poised to accelerate commercialization, with microfluidic soft robotics anticipated to play a transformative role in medical devices, wearable technologies, and agile automation systems.

Leading Companies and Industry Initiatives (e.g., softroboticsinc.com, festo.com, ieee.org)

Microfluidic soft robotics is rapidly advancing, with several leading companies and industry organizations driving innovation and commercialization as of 2025. These entities are focusing on the integration of microfluidic actuation, sensing, and control within soft robotic systems, targeting applications in manufacturing, healthcare, and research automation.

A prominent player in this field is Festo, a German automation technology company recognized for its pioneering work in soft robotics and fluidic control. Festo’s BionicSoftHand and BionicSoftArm projects have demonstrated the use of pneumatic and microfluidic actuation for dexterous, adaptive manipulation. In recent years, Festo has expanded its research into microfluidic-driven soft grippers and end-effectors, aiming to enhance precision and safety in collaborative robotics and delicate assembly tasks. The company’s ongoing collaborations with academic institutions and industrial partners are expected to yield new commercial products by 2026.

In the United States, Soft Robotics Inc. has established itself as a leader in soft robotic gripping solutions, particularly for food processing and e-commerce automation. The company’s mGrip platform leverages soft, pneumatically actuated fingers, and recent developments have incorporated microfluidic channels for finer control and faster response times. Soft Robotics Inc. has announced partnerships with major automation integrators to deploy next-generation microfluidic grippers in high-throughput environments, with pilot programs underway in 2025.

On the research and standardization front, the IEEE Robotics and Automation Society continues to play a crucial role. The society organizes conferences and working groups focused on soft robotics, including microfluidic actuation and sensing. In 2024 and 2025, IEEE has launched new initiatives to develop interoperability standards for microfluidic soft robotic modules, aiming to accelerate adoption in medical devices and laboratory automation.

Other notable contributors include Parker Hannifin, which is investing in microfluidic components for soft robotic medical devices, and Boston Dynamics, which has begun exploring hybrid rigid-soft systems with microfluidic elements for advanced manipulation tasks. Startups and university spin-offs are also emerging, often in partnership with established automation suppliers.

Looking ahead, industry analysts anticipate that the convergence of microfluidics and soft robotics will lead to a new generation of adaptive, safe, and highly dexterous robots. The next few years are expected to see increased commercialization, with leading companies expanding their portfolios and new entrants leveraging advances in materials and microfabrication.

Emerging Applications: Healthcare, Biomanufacturing, and Beyond

Microfluidic soft robotics is rapidly advancing as a transformative technology, particularly in healthcare, biomanufacturing, and adjacent sectors. These systems combine the compliance and adaptability of soft robotics with the precise fluid handling capabilities of microfluidics, enabling new classes of devices for manipulation, sensing, and actuation at small scales. As of 2025, several key developments and emerging applications are shaping the field’s trajectory.

In healthcare, microfluidic soft robots are being developed for minimally invasive surgical tools, targeted drug delivery, and advanced diagnostic platforms. The integration of soft actuators and microfluidic channels allows for devices that can navigate complex biological environments with reduced risk of tissue damage. Companies such as Boston Scientific Corporation and Medtronic plc are actively exploring soft robotic systems for endoscopic and catheter-based interventions, leveraging microfluidic control for enhanced dexterity and precision. These efforts are supported by ongoing collaborations with academic research centers and medical device startups, aiming to bring next-generation soft robotic tools to clinical trials within the next few years.

In biomanufacturing, microfluidic soft robotics is enabling new approaches to cell culture, tissue engineering, and high-throughput screening. The ability to manipulate fluids and biological samples with gentle, programmable motions is critical for maintaining cell viability and reproducibility. Companies like Danaher Corporation (through its subsidiaries in life sciences instrumentation) and Thermo Fisher Scientific Inc. are investing in microfluidic platforms that incorporate soft robotic elements for automated sample handling and organ-on-chip systems. These technologies are expected to accelerate drug discovery and personalized medicine by providing more physiologically relevant models and scalable manufacturing solutions.

Beyond healthcare and biomanufacturing, microfluidic soft robotics is finding applications in environmental monitoring, food safety, and soft wearable devices. For example, soft robotic grippers with embedded microfluidic sensors are being developed for gentle handling and analysis of fragile samples in agriculture and food processing. Companies such as Festo AG & Co. KG are pioneering soft robotic automation solutions that integrate microfluidic control for adaptive, safe interaction with diverse materials and environments.

Looking ahead, the outlook for microfluidic soft robotics is highly promising. Advances in materials science, additive manufacturing, and integrated electronics are expected to drive further miniaturization, functionality, and affordability. Industry leaders and startups alike are poised to introduce commercial products by 2026–2028, with regulatory pathways and standardization efforts underway. As the technology matures, its impact is anticipated to extend across a broad spectrum of industries, catalyzing new capabilities in precision medicine, sustainable manufacturing, and intelligent automation.

Competitive Landscape and Strategic Partnerships

The competitive landscape of microfluidic soft robotics in 2025 is characterized by a dynamic interplay between established technology leaders, innovative startups, and cross-sector collaborations. The field is rapidly evolving, driven by advances in materials science, precision microfabrication, and the integration of artificial intelligence for enhanced control and adaptability. Key players are leveraging strategic partnerships to accelerate commercialization, expand application domains, and address technical challenges such as scalability, reliability, and biocompatibility.

Among the most prominent companies, Parker Hannifin Corporation stands out for its expertise in motion and control technologies, including microfluidic components and soft actuation systems. The company has been actively developing soft robotic platforms for medical and industrial automation, often collaborating with research institutions and OEMs to tailor solutions for specific use cases. Similarly, Festo is recognized for its pioneering work in pneumatic soft robotics and adaptive grippers, with recent initiatives focusing on integrating microfluidic control for finer manipulation and energy efficiency.

Startups are also playing a crucial role in shaping the sector. Companies such as Soft Robotics Inc. are commercializing modular soft robotic end-effectors that utilize microfluidic actuation for delicate handling in food processing and e-commerce logistics. Their partnerships with major automation integrators are expected to expand in the coming years, as demand for flexible, damage-free handling solutions grows. Meanwhile, Fluxergy is leveraging its microfluidic platform expertise to develop soft robotic systems for rapid diagnostics and sample manipulation, targeting both healthcare and laboratory automation markets.

Strategic alliances are increasingly common, with companies forming consortia to address shared challenges and accelerate innovation. For example, collaborations between Parker Hannifin Corporation, leading universities, and medical device manufacturers are focused on developing next-generation soft robotic catheters and minimally invasive surgical tools. Industry bodies such as the International Federation of Robotics are facilitating knowledge exchange and standardization efforts, which are critical for widespread adoption and regulatory compliance.

Looking ahead, the competitive landscape is expected to intensify as more players enter the market and existing companies diversify their portfolios. The next few years will likely see increased investment in R&D, the emergence of new application areas (such as wearable assistive devices and environmental monitoring), and a greater emphasis on interoperability and open-source platforms. Strategic partnerships—particularly those bridging academia, industry, and healthcare—will remain pivotal in overcoming technical barriers and driving the commercialization of microfluidic soft robotics.

Regulatory Environment and Industry Standards (e.g., asme.org, ieee.org)

The regulatory environment and industry standards for microfluidic soft robotics are rapidly evolving as the field matures and transitions from laboratory research to commercial and clinical applications. As of 2025, the convergence of microfluidics and soft robotics—enabling devices with unprecedented dexterity, adaptability, and biocompatibility—has prompted increased attention from standards organizations and regulatory bodies.

Key industry standards are being shaped by organizations such as the American Society of Mechanical Engineers (ASME) and the Institute of Electrical and Electronics Engineers (IEEE). ASME has a long-standing role in developing standards for mechanical systems, including those relevant to robotics and fluidic devices. In recent years, ASME has expanded its focus to include soft robotics, with working groups addressing safety, performance, and interoperability. The IEEE, through its Robotics and Automation Society, is actively developing guidelines for the design, testing, and ethical deployment of soft robotic systems, including those integrating microfluidic actuation and sensing.

In the medical and healthcare sectors, where microfluidic soft robots are increasingly proposed for minimally invasive surgery, drug delivery, and diagnostics, regulatory oversight is intensifying. The U.S. Food and Drug Administration (FDA) has begun to issue guidance on the premarket submission and validation of soft robotic medical devices, emphasizing biocompatibility, sterility, and reliability of microfluidic components. The European Medicines Agency (EMA) and other international bodies are similarly updating frameworks to address the unique risks and benefits of these hybrid systems.

Industry consortia and alliances are also emerging to harmonize standards and accelerate adoption. For example, the International Organization for Standardization (ISO) is collaborating with robotics and microfluidics stakeholders to draft new standards for soft robotic materials, actuation mechanisms, and system integration. These efforts aim to ensure interoperability, safety, and quality across global markets.

Looking ahead, the next few years are expected to see the formalization of test protocols for durability, repeatability, and failure modes specific to microfluidic soft robots. There is also a growing emphasis on cybersecurity and data integrity, particularly as these devices become more connected and data-driven. As regulatory clarity improves, industry leaders anticipate accelerated commercialization, especially in healthcare, manufacturing, and wearable technology sectors.

Overall, the regulatory landscape for microfluidic soft robotics in 2025 is characterized by proactive standard-setting, cross-sector collaboration, and a focus on ensuring safety and efficacy as the technology moves toward widespread deployment.

Challenges: Scalability, Integration, and Cost Barriers

Microfluidic soft robotics, which leverages the precise manipulation of fluids within flexible channels to actuate soft robotic systems, faces several significant challenges as the field moves into 2025 and beyond. Chief among these are issues of scalability, integration with existing technologies, and cost barriers that hinder widespread adoption and commercialization.

Scalability remains a persistent obstacle. While microfluidic soft robots have demonstrated impressive capabilities in laboratory settings—such as delicate manipulation, biomimetic movement, and adaptability—the transition to mass production is fraught with difficulties. The fabrication of microfluidic channels often relies on soft lithography or 3D printing techniques, which, although advancing, still struggle to deliver the throughput and consistency required for large-scale manufacturing. Companies like Dolomite Microfluidics and Fluidigm Corporation are actively developing scalable microfluidic platforms, but the integration of these systems into soft robotics at commercial volumes remains limited by the complexity of multi-material assembly and the need for precise alignment of microchannels within soft substrates.

Integration with existing electronic and mechanical systems is another major challenge. Microfluidic soft robots often require external pumps, valves, and controllers, which can be bulky and incompatible with the compact, flexible nature of soft robotics. Efforts to miniaturize and embed these components are ongoing, with companies such as Parker Hannifin and IDEX Corporation working on microfluidic control modules and compact actuation systems. However, achieving seamless integration that preserves the softness and compliance of the robots while maintaining performance is a technical hurdle that is unlikely to be fully overcome in the immediate future.

Cost barriers also impede the broader deployment of microfluidic soft robotics. The specialized materials—such as silicone elastomers and biocompatible polymers—along with the need for cleanroom environments and precision equipment, contribute to high production costs. While some suppliers, including Dow and Wacker Chemie AG, are working to develop more affordable and scalable elastomeric materials, the price point for high-performance microfluidic soft robots remains above that of traditional rigid or even other soft robotic systems.

Looking ahead, the outlook for overcoming these challenges is cautiously optimistic. Advances in additive manufacturing, material science, and microfluidic integration are expected to gradually reduce costs and improve scalability. Collaborative efforts between material suppliers, microfluidic platform developers, and robotics manufacturers will be crucial in addressing these barriers and enabling the next generation of microfluidic soft robotic systems.

Investment, Funding, and M&A Activity

The microfluidic soft robotics sector has witnessed a notable uptick in investment and strategic activity as of 2025, driven by the convergence of soft materials science, microfluidics, and robotics. This field, which enables the creation of flexible, adaptive robotic systems powered by fluidic circuits, is attracting attention from both established industry players and venture capitalists seeking to capitalize on its potential in healthcare, manufacturing, and wearable technology.

In recent years, several leading companies specializing in microfluidics and soft robotics have secured significant funding rounds. For example, Dolomite Microfluidics, a pioneer in microfluidic component manufacturing, has expanded its R&D partnerships with robotics startups to develop next-generation soft actuators and sensors. Similarly, Parker Hannifin, a global leader in motion and control technologies, has increased its investment in soft robotic platforms, leveraging its expertise in fluidic control systems to support the commercialization of microfluidic-driven robotic devices.

Mergers and acquisitions (M&A) are also shaping the landscape. In 2024, Festo, known for its advanced automation solutions, acquired a minority stake in a European soft robotics startup focused on microfluidic actuation, signaling a trend toward vertical integration and technology consolidation. Meanwhile, Standard BioTools (formerly Fluidigm), a key player in microfluidic instrumentation, has announced strategic collaborations with academic spin-offs to accelerate the translation of soft robotic prototypes into scalable products.

Venture capital interest remains robust, with several early-stage companies reporting seed and Series A rounds in the $5–20 million range. Investors are particularly drawn to applications in minimally invasive surgery, rehabilitation devices, and precision manufacturing, where microfluidic soft robotics offer unique advantages in dexterity and adaptability. Notably, Boston Scientific has publicly disclosed investments in startups developing microfluidic soft robotic catheters and surgical tools, underscoring the sector’s medical potential.

Looking ahead, industry analysts anticipate continued growth in funding and M&A activity through 2026 and beyond, as the technology matures and regulatory pathways for medical and industrial applications become clearer. The entry of large automation and healthcare companies into the space is expected to further accelerate commercialization, while ongoing academic-industry partnerships will likely yield new intellectual property and spinout opportunities.

Future Outlook: Disruptive Potential and Next-Generation Developments

Microfluidic soft robotics is poised for significant advancements in 2025 and the following years, driven by rapid progress in materials science, microfabrication, and integration with artificial intelligence. The field, which merges soft robotics with microfluidic actuation, is increasingly recognized for its potential to revolutionize sectors such as biomedical devices, minimally invasive surgery, and precision manufacturing.

A key trend is the development of more robust and biocompatible elastomers and hydrogels, enabling microfluidic soft robots to operate safely within biological environments. Companies like Dow and DuPont are actively expanding their portfolios of advanced silicones and polymers tailored for soft robotic applications, supporting the creation of devices that can mimic natural tissue movements and withstand repeated deformation.

In 2025, the integration of microfluidic soft robots with real-time sensing and closed-loop control systems is expected to accelerate. This is facilitated by the miniaturization of sensors and the adoption of flexible electronics, with industry leaders such as TDK and Analog Devices providing critical components for embedded sensing and actuation. These advances are enabling soft robots to perform complex tasks autonomously, such as targeted drug delivery and adaptive gripping in delicate assembly lines.

Manufacturing scalability remains a challenge, but the adoption of advanced 3D printing and microfabrication techniques is making it increasingly feasible to produce intricate microfluidic channels and soft actuators at scale. Companies like Stratasys and 3D Systems are investing in high-resolution additive manufacturing platforms that support the rapid prototyping and production of soft robotic components with embedded microfluidics.

Looking ahead, the disruptive potential of microfluidic soft robotics is particularly notable in healthcare. The technology is expected to enable new classes of minimally invasive surgical tools and implantable devices that can navigate complex anatomical pathways with unprecedented dexterity. Collaborations between medical device manufacturers and soft robotics innovators, such as those involving Medtronic, are anticipated to yield commercial products within the next few years.

Overall, the next generation of microfluidic soft robots will likely feature enhanced autonomy, multifunctionality, and biocompatibility, positioning the field for transformative impact across multiple industries by the late 2020s.

Sources & References

- Soft Robotics Inc.

- Boston Scientific

- DuPont

- DSM

- IEEE

- Stratasys

- 3D Systems

- Medtronic

- Boston Dynamics

- Thermo Fisher Scientific Inc.

- Fluxergy

- International Federation of Robotics

- American Society of Mechanical Engineers (ASME)

- International Organization for Standardization (ISO)

- Dolomite Microfluidics

- IDEX Corporation

- Wacker Chemie AG

- Analog Devices